Elevator pitch

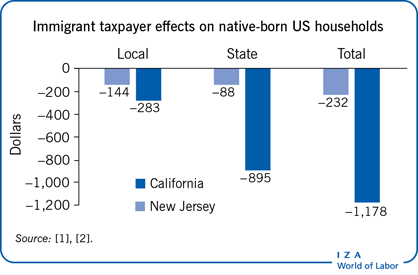

Taxpayer effects are a central part of the total economic costs and benefits of immigration, but they have not received much study. These effects are the additional or lower taxes paid by native-born households due to the difference between tax revenues paid and benefits received by immigrant households. The effects vary considerably by immigrant attributes and level of government involvement, with costs usually diminishing greatly over the long term as immigrants integrate fully into society.

Key findings

Pros

Lower negative taxpayer effects are linked to higher-skilled migrants.

Taxpayer effects are more positive in the long term than at the outset.

Financing the education of immigrant children, rather than welfare, unemployment, or health care, is the major fiscal cost.

Cons

Immigrants are a small share of the population, so the positive taxpayer effects of their contributions to the benefits of the aging native population are too small to resolve long-term fiscal deficits.

The principal data sets in the US and in Europe do not contain essential information for the study of the fiscal impact of immigration.

The best current estimates of taxpayer effects are becoming seriously outdated.